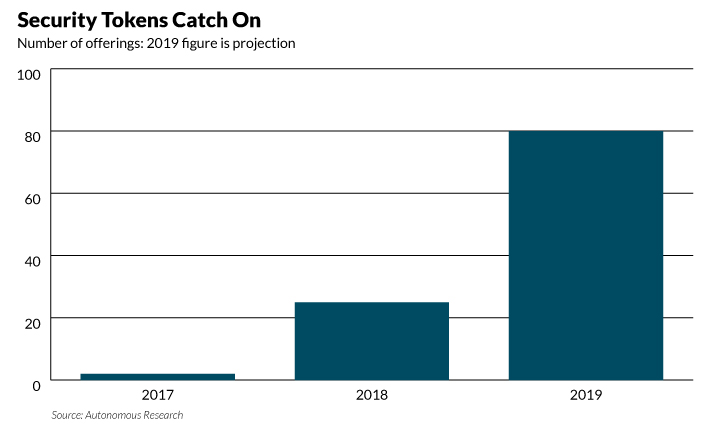

In the crypto world, the perfect keyword to summarize Year 2018 is regulation. The initial coin offering (ICO) market has taken a nosedive since June, 2018 (refer to this report) published by Cointelegraph for the ICO market trend in past two years). At the same time, jurisdictionally compliant security token offerings (STO) started to gain popularity. According to Autonomous Research, the total number of STOs jumped to 25 in 2018 from only two in 2017.

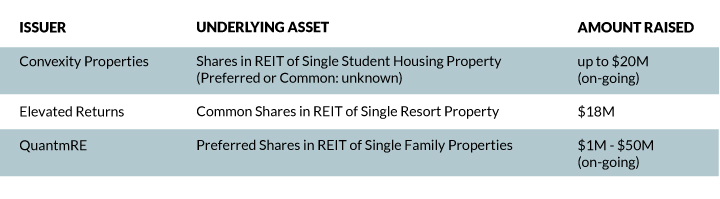

Alternative assets, such as private equity and real estate, seemed the natural candidates to get tokenized with the potential benefit of liquidity enhancement to investors. We, therefore, observed several high-profile security token offerings (STO) of real estate asset.

The acclaimed fundamental rationale behind these security token offerings (STO) projects is that the tokenization and fractionalization would reduce, if not eliminate, transaction cost and increase liquidity and thus create further value to those investors. This article aims to evaluate the validity of this acclaimed rationale by analyzing the Elevated Returns’ security token offering of the St. Regis resort in Aspen, Colorado.

Overview of Elevated Return’s St. Regis Resort STO (1)

New York-based Elevated Returns, the manager of St. Regis resort in Aspen, Colorado, raised $18M via offering of security token – Aspen Coin by partnering with Indiegogo and Templum Markets. Aspen coin, priced at $1 each, was sold to accredited investor ONLY under Reg D 506C. The 18 million tokens issued represent 18.9% stake in the St. Regis resort.

Why Elevated Returns Pivoted to Raise Capital via STO?

Elevated Returns originally planned to operate the resort as a publicly listed and traded single-asset REIT. Single-asset REIT itself is an “innovative” concept. “Conventional” REITs would own a portfolio of real estate assets in order to diversify idiosyncratic risk associated with each property. Single-asset REIT takes away this particular benefit from investors. In late August, 2018, Elevated Returns then announced to the public an even more innovative, if not premature, approach to raise capital for the property. The approach, as we know it, is Reg D 506C compliant STO. Why did the management team at Elevated Returns make such a decision? We are going to look at these two options from the perspectives of the operating company/fund and from that of investors. This exercise might help us to rationalize the decision made by Elevated Returns.

To publicly list a REIT, company has to file Form S-11 with SEC. It took an average of 25 calendar days for the SEC staff to provide initial comments on all Securities Act filings in 2012 (2). The Reg-D compliant STO approach shortens the capital raising lead-time by eliminating the mandate of SEC registry and approval. This shortens the lead-time by at least 25 calendar days. A shorter capital raising lead-time allows companies to better time the market and therefore potentially raise at a more attractive valuation.

Now let’s take a look at the capital raising cost of the two approaches respectively. As you can imagine, the majority of cost for a REIT IPO is the underwriting fee. On average, companies allocate 4-7% of gross proceeds to underwriting (3). For a deal with less than $50M in gross proceeds, we estimate the percentage will lean towards 7%. The fee structure of this particular deal is unknown to the public. However, we can estimate that 5% (4) of gross proceeds would go to Indiegogo for its vital role in listing this deal to its network of accredited investors. This translates to a savings of $360K (2% x $18M) by pursuing the STO instead of public REIT option in this case. Other savings might come from the following categories:

- Stock exchange listing fee: an elimination of >$100K per annum, while listing on NYSE (5).

- Legal fees and expenses: an reduction of unknown amount.

- Accounting fees and expenses: an reduction of unknown amount.

The reduction in both lead-time and fees presents Reg D-compliant STO as a more attractive option than public REIT. The downside comes along with this STO approach, obviously, is the smaller pool of potential investors, which typically leads to lower valuation of the underlying asset.

Let’s now analyze these two approaches from investors’ perspectives. We are going to focus on taxation and liquidity considerations.

It’s mandatory for REITs to distribute at least 90% of its taxable income to shareholders as dividends each year (6). Taxation is calculated based on the retained income after 6 dividend payout. The Aspen Coins are backed by common shares in the REIT that owns the St. Regis Aspen Resort. This means that the Aspen coin investors shall be able to entertain the same tax efficiency of a public traded REIT.

A publicly traded REIT entertains a high level of liquidity as publicly traded stocks. For example, the bid-ask spread is .99% (7) of its price at the time of writing for SOHO, a Nasdaq traded REIT in the lodging/resorts sector with a market capitalization of $108.3M (8). Private REITs, in comparison, faces a relatively high degree of liquidity risk derived from two major reasons.

- A minimum holding period for exists as mandated by regulation

- Very limited secondary market

The Aspen coin would face the same liquidity risk. The lock-up period is 12 months, a mandate under Reg D 506C. Once the lock-up period expires, investors will be able to trade their Aspen coins on Templum Markets, the alternative trading system that Elevated Returns is partnering with. However, how much liquidity it will create will be unknown until the actual trading becomes live. In this aspect, investors will require a risk premium to compensate the additional liquidity risk over a publicly traded REIT.

In Conclusion

Despite the positive momentum of STO, the security token ecosystem is still shaping itself to address other factors not mentioned in this article. For example, the readiness of custodian solution providers, which present an obstacle for institutional investors. What’s more vital, needless to say, is the progression of the regulatory framework development led by SEC.

We believe 2019 will be a pivotal year for security tokens. The sample size will be substantial enough for us to evaluate the acclaimed liquidity enhancement and cost reduction enabled by tokenization of non publicly traded assets. The success of these launched STO projects shall lead to a material increase in the number of security token offerings of small to medium sized single asset private REITs.

(1) Matt Grossman, “$18M Aspen Hotel Sale Lands as First Big Commercial Real Estate Blockchain Deal” (https://commercialobserver.com/2018/10/aspen-st-regis-blockchain-deal/)

(2) David A. Westenberg, “How Quickly Does the SEC Staff Review a Form S-1? [Updated Data]” (https://www.wilmerhale.com/en/insights/blogs/the-road-to-ipo-legal-and-regulatory-insights-into-going-public/how-quickly-does-the-sec-staff-review-a-form-s-1-updated-data)

(3) PWC, “Considering an IPO to Fuel Your Company’s Future?” (https://www.pwc.com/us/en/deals/publications/assets/cost-of-an-ipo.pdf) 4

(4) Indiegogo, “Fees & Pricing for Campaigners: How Much Does Indiegogo Cost?” (https://support.indiegogo.com/hc/en-us/articles/204456408-Fees-Pricing-for-Campaigners-How-much-does-Indiegogo-cost-)

(5) NYSE, “Schedule of Fees and Charges for Exchange Services” (https://www.nyse.com/publicdocs/nyse/markets/nyse-arca/NYSE_Arca_Listing_Fee_Schedule.pdf)

(6) NAREIT, “How REITS Work” (https://www.reit.com/what-reit)

(7) Yahoo Finance, as of 15:00, 02/11/2019; Bid = $7.03, Ask = $7.10 and Price = $7.05 8

(8) Yahoo Finance, as of 15:00, 02/11/2019